Advertising Mid-Year Check-In

Published: July 7, 2023

As we find ourselves at the midpoint of 2023, the domain of advertising has experienced rapid advancement. But, the prevailing challenges of escalating inflation and the shifts in consumer behavior resulting from the global pandemic continue to occupy a prominent position of concern. Encouragingly, economic experts are optimistic, anticipating inflation to slow down in the fall and advertising revenue growth to restore to its typical trajectory by the end of this year.

Let's explore advertising insights provided by experts about what to expect for the remainder of the year and where DOOH stands in the media mix.

According to Group M, global advertising in 2023 is projected to reach $874.5 billion. This growth can be attributed to various factors, such as the continued expansion of digital advertising channels, the emergence of new technologies, and the recovery of economies from the impacts of the COVID-19 pandemic. While Magna's forecast shows advertising revenues reaching $842 billion, reflecting a growth rate of 4.6% over 2022. Despite regional variations and economic challenges in specific markets, the advertising industry is poised for continued growth and innovation in the coming months.

Traditional Media Concerns

Vincent Létang, the EVP of Global Market Research at Magna and author of the Magna report offers valuable insights into the advertising landscape, highlighting potential areas of upheaval. Létang suggests that brands are becoming increasingly concerned about the effectiveness of traditional media formats, particularly in mature markets like television. These concerns stem from the perceived lack of compatibility with digital  platforms and the need for brand safety measures. As the advertising industry continues to evolve, brands are reevaluating their priorities and seeking innovative solutions that align with the changing media

platforms and the need for brand safety measures. As the advertising industry continues to evolve, brands are reevaluating their priorities and seeking innovative solutions that align with the changing media

consumption habits and the imperative of maintaining brand integrity in a complex digital ecosystem.

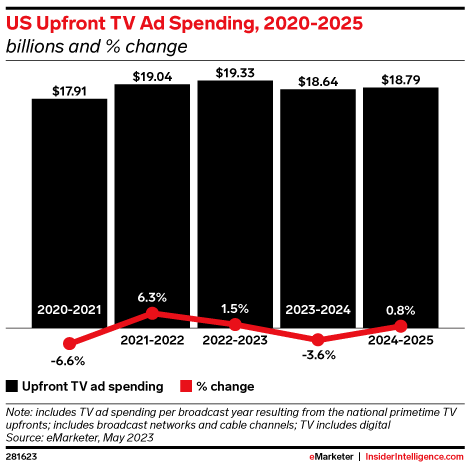

Corroborating these predictions, Insider Intelligence shows similar forecasts, suggesting TV ad spending will experience a decline during the 2023–2024 season on a YoY basis. This trend reflects the industry’s ongoing shift toward digital programming as advertisers recognize their target audiences' changing preferences and behaviors.

Ad Channel Growth

Regarding advertising platforms poised for significant success this year, Group M identifies two key drivers. Among these drivers, out-of-home has the highest percent growth rate YoY, surpassing other channels by a wide margin! OOH is projected to grow substantially in 2023, with a 12.7% increase to $35.6 billion. Notably, DOOH advertising is expected to achieve an even more significant surge, rising by 26.1% to $13.3 billion. This growth reflects the increasing integration of digital technologies in the OOH sector, allowing for dynamic and targeted campaigns.

Secondly, connected TV ad revenue is expected to experience robust growth, with a compound annual increase of 10.4% from 2023 to 2028, reaching an impressive $42.5 billion. This growth can be attributed to the rising popularity and widespread adoption of connected TV devices, providing advertisers with new avenues to reach audiences.

Group M reports digital advertising is experiencing a deceleration, with an anticipated growth rate of 8.4% in 2023. This represents the slowest increase since the 2009 financial crisis. This downshift should be viewed in the context of the digital space's size and maturity rather than as a result of a broader economic slowdown. But fear not; digital ad revenue is still expected to account for a significant share of total global ad revenue, reaching 68.8% in 2023. Dentsu forecasts second this projection stating that the format has matured and will level out, expecting to moderate to 7.8% growth to $424.2 billion.

Unforeseen Events

Unforeseeable events such as geopolitical conflicts, like the war in Ukraine, economic downturns, and the rapid advancement of AI technology, hold the potential to disrupt advertising predictions. The ever-increasing role of AI in advertising is an area of particular attention. Kate Scott Dawkins, President of GroupM's Business Intelligence unit, highlights this shift, stating, "The inflection point now [is that artificial intelligence is] growing much more broadly across use cases and channels, and the number of companies that are involved and potentially involved in creating those tools is different, and is something that we continue to discuss and watch and plan for as that ticks up to 60%, 70%, 80%, 90% of advertising revenue globally.”

All forecasts and insights provide an optimistic outlook for the advertising realm, as economic stabilization and a return to normalcy pave the way for increased ad spending. With the gradual recovery of economies, advertisers will regain confidence and get back on track to invest more in their marketing efforts. As the advertising landscape evolves rapidly, advertisers must remain flexible and adaptable to emerging trends, changing consumer behavior, and technological advancements. By staying attuned to these shifts and proactively adjusting strategies, brands can position themselves to capitalize on new opportunities, including the power of DOOH, and effectively navigate potential challenges.

Written By: Julia Cramer

To get the latest updates on out of home advertising, digital marketing and technology, follow us on:

Or sign up for our newsletter.